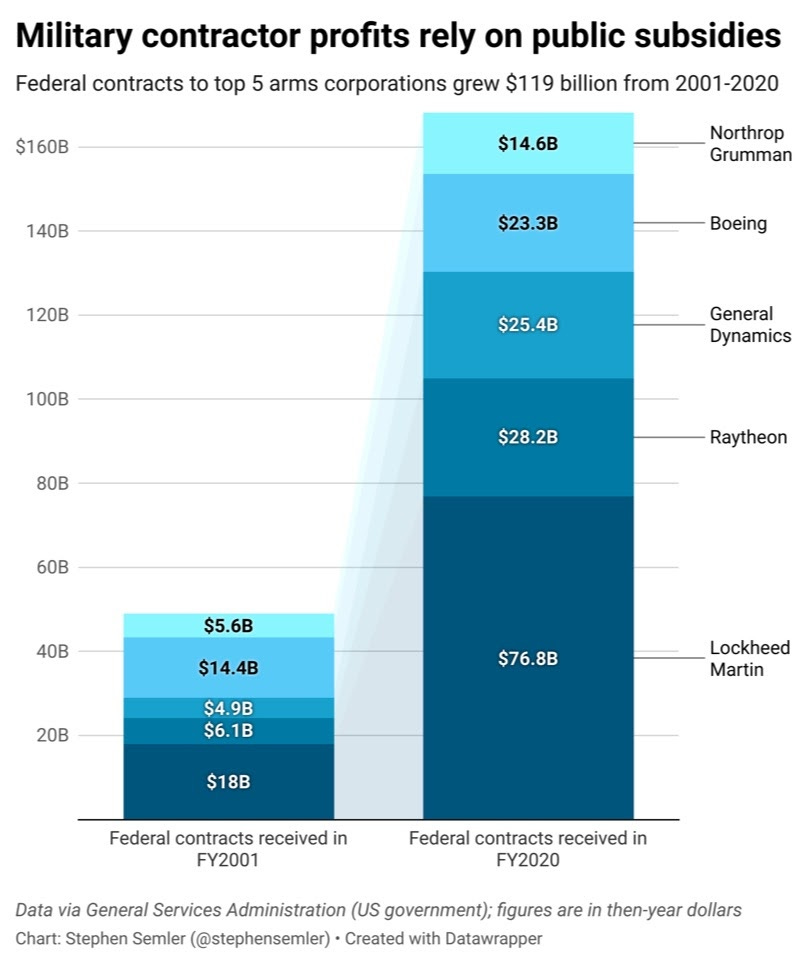

Military contractor profits rely on public subsidies

Speaking Security Newsletter | Advisory Note for Organizers and Candidates, n°105 | 18 August 2021

If you find these notes useful, you can support this newsletter here and SPRI, here. Sharing these newsletters also helps. Thank you!

The Intercept published a really cool study on how much $10,000 of stock spread across the (current) top 5 military contractors in 2001 would yield in current dollars. Answer is $97,295, meaning that the investment would have outperformed the overall stock market by 58 percent during the course of the war in Afghanistan.

A foreign policy built around endless war probably inspired a good bit of investor confidence in these weapons firms. Company earnings play a role in a stock’s price, too—not to mention dividends (which the Intercept study factored in by reinvesting them)—and, taken together, this tranche of arms corporations’ earnings are mostly derived from federal government contracts. They’re subsidized.

*Figures below exclude revenue from foreign military sales. These sales are brokered by the US government about half the time.

Thanks for your time,

Stephen (@stephensemler; stephen@securityreform.org)

Find this note useful? Please consider becoming a supporter of SPRI. Unlike establishment think tanks, we rely exclusively on small donations.