Arms companies pay shareholders more cash than they generate

Polygraph | Newsletter n°320 | 30 Oct 2025

IN THIS NEWSLETTER: Predicting how the arms industry would prioritize spending the surge of cash from a trillion-dollar Pentagon budget.

*Latest newsletter for Polygraph VIPs: Big profits, rare losses among the top military contractors

Situation

Earlier this month, the Senate made time during the government shutdown to pass its version of the annual National Defense Authorization Act (NDAA), 77-20, which backs a $926 billion military budget in 2026.

That amount excludes the extra $156 billion for the Pentagon in the GOP’s hugely expensive reconciliation bill passed in July, most of which the White House plans to use in 2026, with leftover funds remaining available through 2029. (For more, see Julia Gledhill’s expert rundown of the military spending in Trump’s megabill.)

All told, there’s a pending $1.045 trillion military budget for 2026.1 Also pending: an arms industry windfall. Based on the findings of this Brown University study, history suggests that more than half of next year’s military budget will go to for-profit contractors.

What would military contractors do with additional cash?

This is a relevant question because, as you may have gathered from the above, the arms industry is on the verge of receiving a hell of a lot more cash. To predict how contractors would prioritize spending it, I looked at how they’ve spent the cash they already had. Specifically, I compared how major arms firms behaved under the last two administrations — during which time arms industry revenue soared — to forecast their likely behavior under this one.

As a sample, I collected data on the five largest Pentagon contractors: Lockheed Martin, Raytheon (now RTX), Boeing, General Dynamics, and Northrop Grumman. I reviewed each company’s annual 10-K filings from 2017 to 2024, recording revenues, profits, stock buybacks, and shareholder dividends, as well as net cash provided by operating activities and capital expenditures to calculate free cash flow (defined and discussed below).

I then threw out the Boeing data because its commercial business is half the company, and that half built airplanes that fell out of the sky, tanking Boeing’s profits and prompting the unusual step of halting stock buybacks and dividends, which ultimately distorted my dataset a few years later.2 Not to worry: the remaining four firms, while not representative of the tens of thousands of Pentagon contractors, receive over a quarter of Pentagon contracts (27% from 2017–20; 26% from 2021–24), providing meaningful insight into how the arms industry allocates its cash.

What military contractors do with additional cash

“Deliver growth and outstanding value to shareholders,” as Lockheed Martin’s CEO once put it.

Free cash flow is the cash a company has left over from its business operations after paying operating and capital expenses (formula: free cash flow = operating cash flow – capital expenditures). It’s the money a company could have used to do things like raise wages, lower prices, or improve working conditions. What the company does with that free cash instead reflects its priorities.

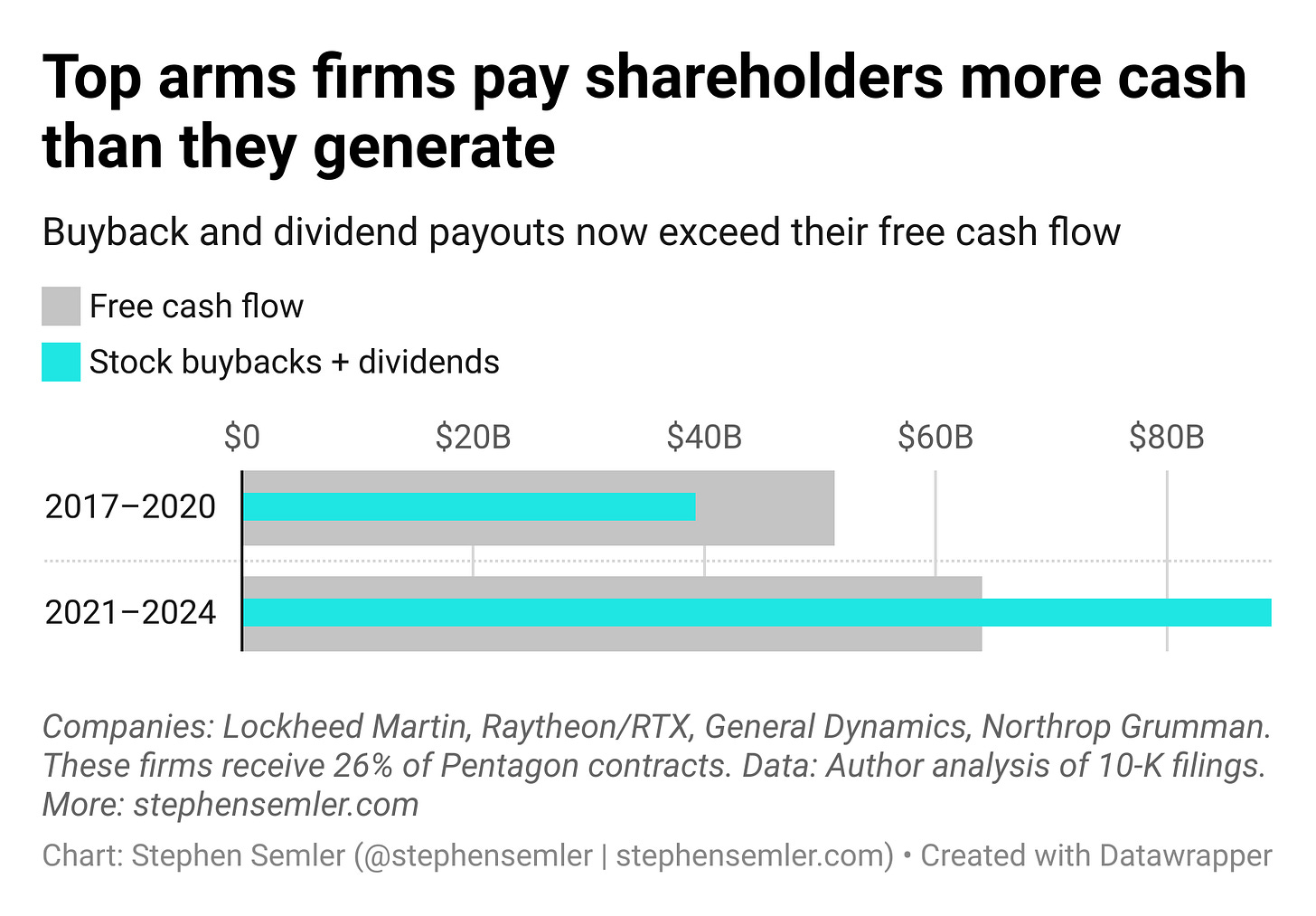

From 2017–2020, Lockheed Martin, Raytheon (RTX), General Dynamics, and Northrop Grumman spent 76% of their free cash on stock buybacks and dividends ($39 billion).

From 2021–2024, these top contractors spent 139% of their free cash on buybacks and dividends ($89 billion), paying out $25 billion more to shareholders than they generated in free cash flow ($64 billion).

Arms companies are willing to take on debt to reward shareholders. That previews how they’ll likely prioritize spending the largesse from a trillion-dollar Pentagon budget.

Both buybacks and dividends involve pulling money out of the company and giving it to shareholders. When the combined amount of cash pulled out of a company exceeds the amount of cash generated by the company, that company is said to be “eating its seed corn” — seed corn being the special seeds you save to grow next year’s crop, not immediately devour like a greedy, crazed chicken.

This might be normal corporate behavior, but the kernel3 of the issue here is that these are not normal corporations. The four firms included in this study are, for all intents and purposes, public firms. The combined 2024 revenue of Lockheed Martin, Raytheon (RTX), General Dynamics, and Northrop Grumman was $241 billion, 64% of which came directly from US government contracts — or 72% when including US government–brokered (and often partially US government–funded) foreign arms sales.

Socialize the costs, privatize the profits.

^Alt text for screen readers: Top arms firms pay shareholders more cash than they generate. Buyback and dividend payouts now exceed their free cash flow. This bullet chart compares free cash flow and stock buybacks plus dividends, in billions of dollars. For 2017 to 2020, 51 to 39; for 2021 to 2024, 64 to 89. Included firms: Lockheed Martin, Raytheon (RTX), General Dynamics, Northrop Grumman. These firms receive over a quarter of Pentagon contracts. Data: Author analysis of 10-K SEC filings.

SPECIAL THANKS TO: Abe B., Alan F., Amin, Andrew R., AT., B. Kelly, BartB., BeepBoop, Ben, Ben C.,* Bill S., Bob N., Brett S., Byron D., Carol V., Chris, Chris G., Cole H., D. Kepler, Daniel M., Dave, David J., David S.,* David V.,* David M., Elizabeth R., Errol S., Foundart, Francis M., Frank R., Gary W., Gladwyn S., Graham P., Griffin R., Hunter S., IBL, Irene B., Isaac, Isaac L., Jacob, James G., James H., James N., Jamie LR., Jcowens, Jeff, Jennifer, Jennifer J., Jessica S., Jerry S., Joe R., John, John, John A., John K., John M., Jonathan S., Joseph B., Joshua R., Julia G., Julian L., Katrina H., Keith B., Kheng L., Lea S., Leah A., Leila CL., Lenore B., Linda B., Linda H., Lindsay, Lindsay S.,* Lora L., Mapraputa, Marie R., Mark L., Mark G., Marvin B., Mary Z., Marty, Matthew H.,* Megan., Melanie B., Michael S., Mitchell P., Nick B., Noah K., Norbert H., Omar A., Omar D.,* Peter M., Phil, Philip L., Ron C., Rosemary K., Sari G., Scarlet, Scott H., Silversurfer, Soh, Springseep, Stan C., TBE, Teddie G., Theresa A., Themadking, Tim C., Timbuk T., Tony L., Tony T., Tyler M., Victor S., Wayne H., William P.

* = founding member

-Stephen (Follow me on Instagram, Twitter, and Bluesky)

$1.045 = $925.8 billion (the topline amount in the Senate NDAA) + $119.3 billion (planned military spending through the reconciliation bill in 2026).

Before the 737 MAX scandal and Covid-19, Boeing had higher profits than the others in the sample, at least from 2017–18.

I hate myself. Also, if you’d like to read more about seed corn, I strongly advise a Google image search for the term now that I have learned — without my consent — that seed corn can also refer to gruesome-looking calluses on people’s feet.

Thank you for the third footnote, humor brings down my blood pressure.