Taxpayers bankroll military contractors’ buybacks and dividends

Polygraph | Newsletter n°321 | 3 Nov 2025

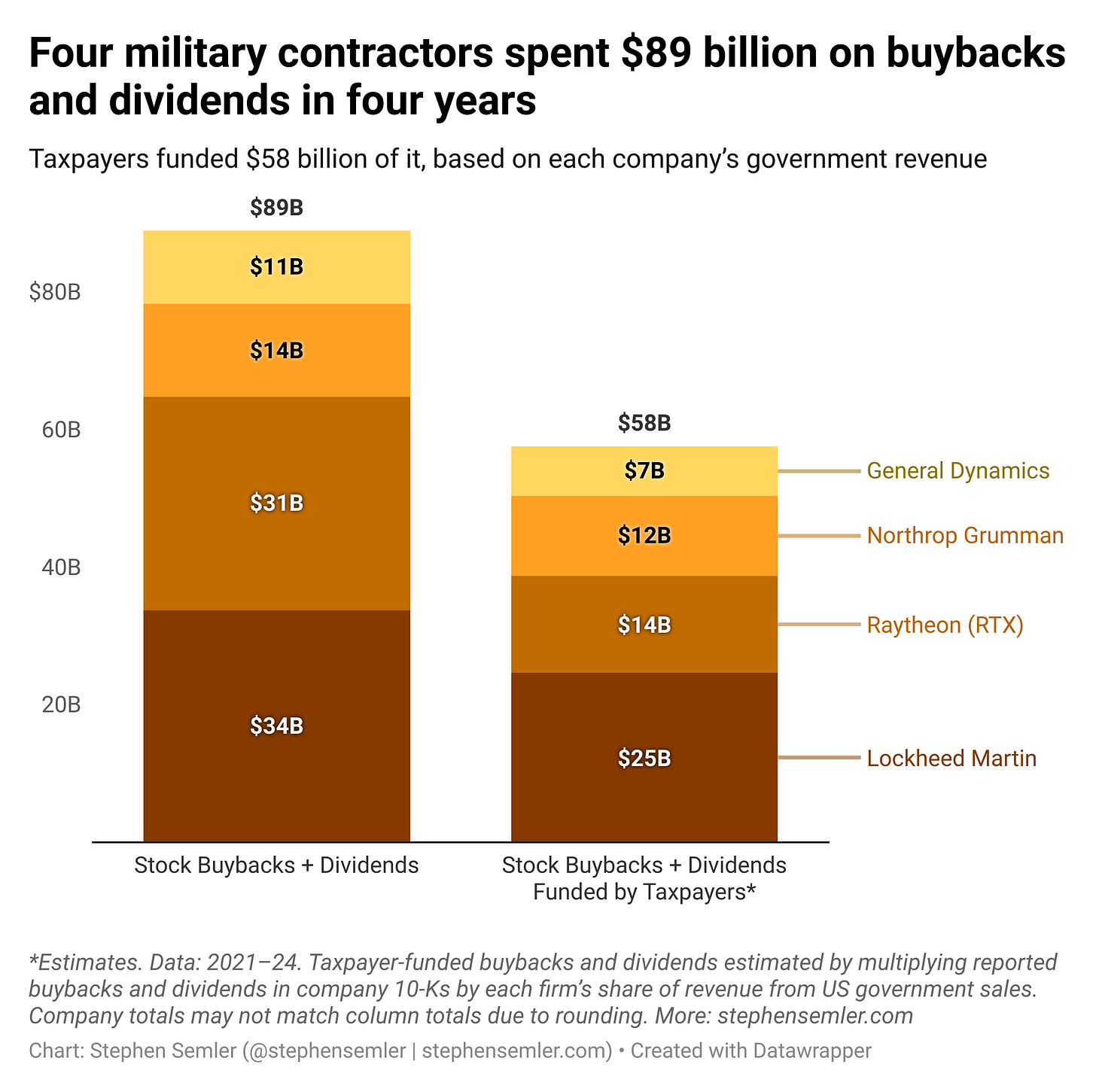

IN THIS NEWSLETTER: The top four military contractors spent $89 billion on stock buybacks and dividends over the last four years. Here’s how much of that came from US taxpayers.

*Please consider joining the esteemed list of paid subscribers thanked at the bottom of each note. They make research like this possible.

Four contractors, four years, $89 billion in buybacks and dividends

In Thursday’s newsletter, I reported that four top military contractors — Lockheed Martin, Raytheon (now RTX), General Dynamics, and Northrop Grumman — increased spending on stock buybacks and dividends from $39 billion under Trump to $89 billion under Biden, based on my review of each company’s 10-K filings from 2017–2024.

In this newsletter, I ask the following: How much of the $89 billion spent on shareholders over the last four years came from US taxpayers? (Answer: about two-thirds. Read on for more.)

Subsidizing shareholder payouts

While corporations in general are increasingly focused on rewarding shareholders — particularly through buybacks — military contractors are not normal corporations. To paraphrase economist John Kenneth Galbraith, the big arms firms are really public firms. Here are the top four US arms firms1 with the share of their 2021–2024 revenue from US government contracts:

Lockheed Martin: 73%

Raytheon (RTX): 45%

General Dynamics: 67%

Northrop Grumman: 86%

Based on the percentage of each company’s revenue that came from the US government, an estimated $58 billion of the $89 billion that Lockheed Martin, Raytheon (RTX), General Dynamics, and Northrop Grumman spent on buybacks and dividends from 2021–2024 was financed with public funds.2

I arrived at this estimate by recording each company’s sales to the US government, dividing those sales by total revenue, then multiplying that share by the amount spent on buybacks and dividends. As an example, here’s what the Lockheed Martin calculation looks like:

2024 revenue: $71,043,000,000

2024 sales to US government: $52,044,000,000

2024 buybacks + dividends: $6,759,000,000

US government sales/revenue = 0.7325704151

(Buybacks + dividends) × (US government sales/revenue) = $4,951,443,436

Est. taxpayer-funded buybacks + dividends = $4,951,443,436

Repeat process for 2023, 2022, and 2021.

Add estimated annual totals together.

Insert four-year sum ($24,647,931,510) into pumpkin-spice-themed chart, as seen below. Pumpkin spice optional.

I repeated this process 12 more times (three remaining firms × four years).3 These estimates assume that the share of buybacks and dividends funded by US taxpayers reflects the share of company revenue from US government sales, and are conservative estimates for that reason.4 Revenue from foreign arms sales brokered by the US government, which can also be partially funded by the US government, is accounted for separately in company 10-K reports and is therefore excluded from this analysis.

*

To review, four de facto public firms in four years spent $89 billion rewarding shareholders, an estimated two-thirds of which came from public funds that could have otherwise gone to helping people afford groceries. This $58 billion in taxpayer-funded buybacks and dividends would be enough to deliver SNAP benefits to its 41.7 million recipients for the next seven months.

SNAP recipients will reportedly only receive partial benefits this month. It’s a problem, apparently, to subsidize groceries, but it’s somehow fine to subsidize arms company shareholders. Consider spicing up your next holiday gathering by bringing this up at the dinner table.

^Alt text for screen readers: Four military contractors spent $89 billion on buybacks and dividends in four years. Taxpayers funded $58 billion of it, based on each company’s government revenue. Stock buybacks and dividends, by contractor, in billions of dollars: Lockheed Martin, 34; Raytheon (RTX), 31; Northrop Grumman, 14; General Dynamics, 11; total, 89. Estimated stock buybacks and dividends funded by taxpayers: Lockheed Martin, 25; Raytheon (RTX), 14; Northrop Grumman, 12; General Dynamics, 7; total, 58. Data: 2021 to 2024. Taxpayer-funded buybacks and dividends estimated by multiplying reported buybacks and dividends in company 10-K filings by each firm’s share of revenue from U.S. government sales. Company totals may not match column totals due to rounding.

SPECIAL THANKS TO: Abe B., Alan F., Amin, Andrew R., AT., B. Kelly, BartB., BeepBoop, Ben, Ben C.,* Bill S., Bob N., Brett S., Byron D., Carol V., Chris, Chris G., Cole H., D. Kepler, Daniel M., Dave, David J., David S.,* David V.,* David M., Elizabeth R., Errol S., Foundart, Francis M., Frank R., Gary W., Gladwyn S., Graham P., Griffin R., Hunter S., IBL, Irene B., Isaac, Isaac L., Jacob, James G., James H., James N., Jamie LR., Jcowens, Jeff, Jennifer, Jennifer J., Jessica S., Jerry S., Joe R., John, John, John A., John K., John M., Jonathan S., Joseph B., Joshua R., Julia G., Julian L., Katrina H., Keith B., Kheng L., Lea S., Leah A., Leila CL., Lenore B., Linda B., Linda H., Lindsay, Lindsay S.,* Lora L., Mapraputa, Marie R., Mark L., Mark G., Marvin B., Mary Z., Marty, Matthew H.,* Megan., Melanie B., Michael S., Mitchell P., Nick B., Noah K., Norbert H., Omar A., Omar D.,* Peter M., Phil, Philip L., Ron C., Rosemary K., Sari G., Scarlet, Scott H., Silversurfer, Soh, Springseep, Stan C., TBE, Teddie G., Theresa A., Themadking, Tim C., Timbuk T., Tony L., Tony T., Tyler M., Victor S., Wayne H., William P.

* = founding member

-Stephen (Follow me on Instagram, Twitter, and Bluesky)

Top four excluding Boeing, which remains a top military contractor but is excluded from this study because a scandal in its commercial sector made it an extreme outlier.

Of the $89 billion spent on stock buybacks and dividends from 2021–2024, $54 billion went to buybacks. I estimate that $36 billion of those buybacks were taxpayer-funded.

If you’re interested only in the four-year topline figures, you can skip the granular, painstaking/painful methodology deployed here by simply adding all the US government sales together for the four companies over the four years ($570,276,000,000), dividing that by the total revenue ($878,662,000,000), then multiplying that share by the total buybacks and dividends reported in the company 10-K filings ($88,936,000,000) from 2021–2024. Your estimate will end up a little high (by about $178 million) but will still round to $58 billion — the same rounded figure as I got through my methodology, which takes ten times as long and produces (in this case) a 0.3% better estimate. Welcome to Polygraph.

Could these firms assert that they don’t fund buybacks and dividends using proceeds from government contracts? I suppose they could, but they’d be claiming that they don’t treat money as fungible. Money is money: once either commercial or government cash hits their books, it becomes part of the same pool that supports all types of corporate spending. Besides, that sort of accounting distinction would be semantic, not substantive. These companies’ business models are built on taxpayer-funded stability. Buybacks and dividends depend on cash flow, and the supermajority of these firms’ collective cash flow is from government contracts. Freeze all government contracts to these firms and see what happens to their buybacks and dividends.